From Local TV→ 60 Minutes→The Breakfast Club

My journey through the media landscape in my quest to communicate economics

Five years ago, I began my role as chief economist at Redfin. Before taking on this role, I was a senior economist at Amazon, working on problems related to employee engagement. I had extensive experience performing research that executives would scrutinize. Still, I had almost no experience communicating research to an external audience. My role as chief economist at Redfin is primarily one of communication, so I had a long way to go to reach my ultimate goal of being the go-to housing market economist for journalists.

After receiving some media training from the Redfin communications team, I got to work talking to reporters and doing broadcast interviews. My first on-screen interview was with a local Seattle TV station, Kiro 7, about how Amazon's announcement of a second headquarters might impact the Seattle housing market.

Given my role at Redfin and my experience working for Amazon, I had the expertise to do this interview, but I was incredibly nervous to go on TV for the first time. However, I knew the best antidote to nerves was experience, so I kept putting myself out there, taking on whatever interviews I could get to hone my communication skills.

The next break I got was a live TV interview with CNBC. Before this interview, I had only done local TV spots, so getting a national interview was a big deal. This interview format was especially tough. Before the Zoom era, these kinds of interviews would take place in a remote studio, where my only interaction with my interviewer was through a single earpiece. I had to learn to look directly at the camera while focusing on the sound coming through my left ear. Again, because this experience was brand new, I was nervous. To get my mind off my worries while sitting in the hot seat waiting for my hit time, I would count by sevens in my head to focus on anything but my anxiety.

After doing a few of these live interviews for CNBC and Bloomberg, my nervousness faded away. I gained confidence in my abilities and focused on my next goal: landing an interview on national prime-time television.

It took me 3.5 years to reach that goal, but in 2022, 60 Minutes came calling for a segment on investor activity in the housing market. This was my first in-person interview since the start of the pandemic. Sitting face-to-face with Lesley Stahl was an uncanny experience as she peppered me with questions about how investors were boxing out first-time homebuyers.

With this interview, I had reached the mountaintop of economic communication. According to Nielsen ratings, 60 Minutes is the most popular news television show on air, averaging nine million viewers. But, even though nine million people watch 60 Minutes, none of my friends tuned in. Sure, they saw the clips posted to my social media, but I felt like even after this colossal accomplishment, I was missing something.

For me, the true goal of communicating economics is to reach people who don't usually read or watch economic news. If I can get someone interested in economics who never showed interest before, that's more valuable than preaching to the converted.

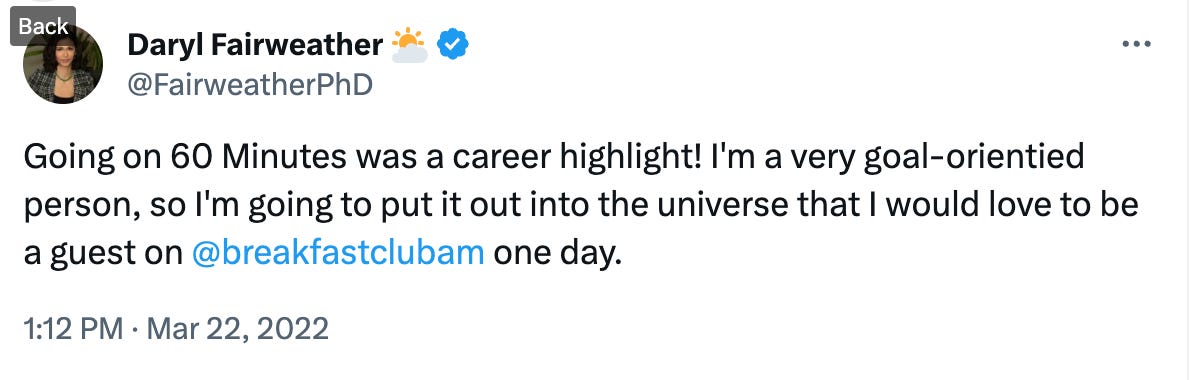

After some reflection, I decided my next goal would be to reach a younger and more diverse demographic. The Breakfast Club was that show. It is a nationally syndicated show on hip-hop stations, reaching 4 million listeners—the kind of listeners who have probably never seen an episode of 60 Minutes.

So I put this wish out into the universe via a tweet, and somehow, the show's co-host, Angela Yee, saw it and invited me on the show.

Going on The Breakfast Club was a career highlight. I was going where no economist had gone before, reaching audiences that generally don't learn about the economy or how it impacts their lives. The hosts, Angela Yee, DJ Envy, and Charlamagne Tha God, engaged me with thought-provoking questions and showed the world that Black people can and do carry on intelligent conversations about the economy.

Since this interview, Angela Yee left The Breakfast to start her own nationally syndicated radio show, Way Up with Angela Yee, with her co-host Jasmine Brand. I’m especially proud of this interview because it's rare to see three Black women talking amongst themselves about the economy and the housing market.

Angela Yee told me that if she had seen someone like me talking about the economy when she was younger, she would have wanted to be an economist, and that encompasses my internal motivation for why I do what I do. I'm so grateful that she shares her platform with me so I can reach the fanbase that she has spent her career cultivating.

I no longer feel like anything is missing from my economics communications career. I'm speaking to all of the audiences I set out to reach. I feel fulfilled.

Transcript edited for clarity and brevity.

Angela Yee

What's up? It's way up with Angela Yee. I'm Angela Yee and Jasmine Brand is here with me. Yes. And honestly one of my favorite people to talk to Daryl Fairweather is here, Chief Economist at Redfin. Thank you for joining us again.

Daryl Fairweather

I'm so happy to be here.

Angela Yee

You know we like to have these conversations and what I love whenever you come you defy what people would think any kind of a chief economist would look like you know, so I love that. You make talking about this fun

Jasmine Brand

And she's a regular up here at this point too. Yeah,

Angela Yee

This is a very intimidating topic for a lot of people, you know, to talk about the economy, to talk about the housing market. And I want to start up with just this question. Is this a good time for a first time home owner to buy? Yes or no. And we want to hear why?

Daryl Fairweather

I'm gonna be honest, there are many things that are challenging about the housing market right now. The first thing is, how high mortgage rates are. Mortgage rates are basically how much it costs to borrow money to buy a home, and for 30 year fixed rate, It's at seven and a half percent right now. During the pandemic it was at around three percent so more than doubled.

Angela Yee

Yes. So how much does that add? Like say your mortgage is 100 thousand dollars, how much um, is a difference like say if it was three percent rate as opposed to a 7.5 percent.

Daryl Fairweather

It's going to be [50%] more than double the amount of money that you're going to have to pay over the life of the mortgage to pay that off it. It's a huge deal and it's made buying really expensive especially for people who borrow to buy a home, right?

Not many people have the cash to buy a home, especially with how high home prices are, and home prices got quite high during the pandemic and have not come down. They're actually higher than they were last year so that makes it extremely challenging. I will say that the good news is that because there isn't much buyer competition in the market right now, it's easier for people who are putting down lower down payments. So during the pandemic, you had to have all cash or at least 20 percent down.

So if you're only putting five percent down if you have an FHA loan which is the kind of loan you get if you have a lower credit score or your first time home buyer, you can get those kinds of offers accepted. So it's a bit easier to break into the housing market. The hard part is having the money and finding a home that you actually want to buy.

Angela Yee

Is it hard to get a mortgage now?

Daryl Fairweather

No, so it's more expensive to get a mortgage, but i don't think it's harder to get the mortgage. Actually, the kinds of people who are getting mortgages right now tend to have lower credit scores and they did during the pandemic, okay?

Jasmine Brand

So the answer to the question is, yes, and no?

Daryl Fairweather

I would say it's mostly harder.

Angela Yee

I want to take that to an article that you wrote for Forbes, yeah, okay. Four ways to buy your first home even as affordability worse. Since we like solutions.

Daryl Fairweather

So to answer your question, I think for most people, it's going to be more affordable for them to rent than it is to buy a home. So in that sense it is hard to be a first time home buyer. I think a lot of people are going to postpone it this year and decide to rent instead. But the downside of that is that when you, if you delay buying a home, when mortgage rates, drop competition is going to come back. It's going to be really fierce. So delaying the decision. It might be even harder down the road. So, if you do want to buy, now, there are things that you can do. You could team up with, somebody. Doesn't have to be your married partner, it could be a friend and buy a home together. Make sure that you, like, figure out the paperwork.

Angela Yee

Yeah, make sure you legally, get that done. They can't just be a. That's my friend. That person would never do this to me.

Daryl Fairweather

Have a contract like If you're going to live in the home and your co-investor is not then treat it like they're your landlord and you're a tenant. Have it all written out, decide what you're going to do, if you're going to sell, but that is a way to afford home, ownership a little bit early. Another thing is that if you live in a really expensive area and you can't afford to buy there, you may be able to buy some place more affordable even if you're not ready to move to that more affordable place. You could use it as an investment property or a rental property and be able to build equity. So you can upgrade to the home that you do want later on.

Angela Yee

All right, those are all great tips about buying your first home. Now since you talked about, perhaps if you live in a place that's expensive and investing somewhere else, let's talk about what's happening with these crackdowns on Airbnbs. And I know it's an issue in New York City. I think now you have to like register. There's all these new laws in New York City about being able to have an Airbnb property. So can we talk about that for a second?

Daryl Fairweather

Yes. So what happened is, they basically outright banned short-term rentals, Airbnbs. And this is, this is a win for the hotel industry, at least existing hotels, because what's going to happen is that without Airbnbs, it's going to be more expensive to get a short-term rental or hotel stay in New York. You know i interned in New York when I was a college student. So people like that are going to have a bit of a harder time, finding an option. But the good news is that the housing units that aren't being used for Airbnbs, they could potentially be used for long-term rentals for long-term residents.

I think that's the idea behind it. But in general, i think they went too far. I would have preferred to see them tax those airbnbs bring in the revenue and make the tax systems. Such that, you know, if you are trying to rent a spare room, you can still do that, make some money. But if you're a corporate Airbnb landlord, tax them a lot.

Angela Yee

I see now there's a lot of people renting their homes on like Craigslist. They're on the black market because they can't use Airbnb.

Daryl Fairweather

Now yes, when it goes underground it doesn't get taxed. That money doesn't come back to the people of New York. So i'm more in favor of having a lot of taxes as opposed to outright bans.

Angela Yee

I was also talking about Airbnb squatters. Now, this story was huge in the news. I think this was in like Brentwood, California. And there was somebody who was staying there, basically not paying for the Airbnb for over like a year and a half and the person can't get them out. Yeah. Can you break down? How can something like that happen? They're not even paying, and they're not being told. They have to leave. Right?

Daryl Fairweather

So there are many laws and places where tenants have rights if your landlord is not keeping the building up to code, or if they're doing something else kind of shady, the tenant can, in some places choose, not to pay rent because they're landlord is not providing a service. Now, what happened in that situation, was this person, rented it for six months. So, they turned into a long-term tenant, not just an Airbnb person. So they were able to take advantage of all, those tenant protections that are, you know, not really intended for this circumstance. And that's why it's this whole big legal battle.

But I think, the lesson is that if you're going to rent out your home, whether it's on Airbnb or to a long-term renter, do your research, learn the law, there are risks involved. It's not just easy money. You have to know that you're taking on a risk if you're going to become a landlord.

Angela Yee

I've heard so many horror stories about people having to evict tenants, and i think sometimes people don't have a lot of sympathy for landlords. And that's another thing you did this whole article about the economy and how you have to approach it from different. Points of view, right? How does it affect a homeowner but how does it affect renter? Also and I do feel like because you know with certain issues trying to get somebody out, they're not paying their rent. A lot of times that person is able to like continue to stay or go to a court. Yeah. And say that they need more time and still not even have to pay. Do you think that there needs to be something stricter when it comes to that? Because i understand in certain circumstances that the landlord isn't keeping up their end of the bargain, but when they are, and then now it's a struggle for them to even be able to pay their mortgage or they thought they were doing a great investment and it turns out to be a nightmare, what can happen there, right?

Daryl Fairweather

So landlords they provide a service, you know, the good ones, they are doing work to keep the property maintained and make sure that it is habitable for their tenant. So there needs to be some kind of balance between tenants rights and landlord rights. You know, there's some parts of the country, Arkansas for example, where it probably skews more heavily towards landlords and that's not necessarily good for tenants, but there are some places like Seattle that are very heavy on tenants’ rights and then landlords can get discouraged by that. And we do need rental properties in the market.

If you make things too skewed towards tenants and landlords feel like it's not a good deal for them, they're going to take those units off the market and they're not going to be available for rentals. They may even hold them vacant as opposed to even having a tenant and there. And that's not good for the housing supply problem at all.

Angela Yee

Now I wanted also discuss with you a housing bubble because i keep saying, are we having experiencing a housing bubble? And what is going to happen? Will these interest rates come down at any time or even like you said, the prices of these homes, even though they shot up during Covid and then maybe it's slowing down. They still haven't come back down and stabilized, right? So, do you think that we're in a housing bubble?

Daryl Fairweather

I think that there were bubbles across the country that have already popped. Austin for example, prices shot up and now they have come back down. Boise is another example. Prices are down from before the pandemic and the Bay Area and in Los Angeles. So I think that there has been this correction in the market in certain parts. Overall, I don't think we're going to see a huge fraction, if industry's stay really you might see prices come down, one percent, two percent, but it's not going to be anything like 2008 or prices fell by 20 percent

Jasmine Brand

I was really hoping that would happen again.

Angela Yee

Can you imagine? Let me tell you something. I kick myself, during the pandemic, when everybody was leaving New York City, for not buying something in Manhattan. Because they were so many amazing deals that could have been had at that time. People were just trying to get rid of their properties.

And I knew everyone was gonna end up coming back. We just didn't know when the pandemic was was going to end. But we knew it would. And New York was like, I've never seen anything like that, you know. And so sometimes I said it to myself too. But I was so dead set on staying in Brooklyn, right? That I ended up buying a house in Brooklyn instead, when everybody was moving to Brooklyn. So financially sometimes, and emotionally, the decisions that we make don't match up with financially the things that we could be doing.

Daryl Fairweather

That's so true. And you know, there's like a saying in investing: when everyone's zigging you zag. I mean I think that's true to a certain extent but I think so much of it depends on how much risk your willing to take on. How long are you willing to wait to see the returns on that investment? So people took that risk and bought property when they were down and made the bet that it's going to come back, and they did do well. But other places, like I said, in Austin, some people bought as the market was going up and it's come back down. So you have to be comfortable with the risk if you're going to get involved and investing.

Angela Yee

What do you see happening in Miami? I was also seeing some research in Miami. Miami was a place that people were flocking to as well, right? They were doing that because of taxes, but they were also doing that because it was a work from home, work remotely situation. What do you see happening there in the near future?

Daryl Fairweather

Well, in our Redfin data we see that Florida is extremely popular. It's one of the housing markets that continues to do well, even with these high interest rates. You know, people are retiring. Baby boomers are big generation. They're moving down to Florida, people who are working remotely or going to Florida, and it just continues to be a really popular place, but I do think that that's not going to be sustainable.

Especially given how much insurance costs are going up. There was a report by Policygenius that showed that Florida insurance quotes went up the most out of anywhere in the country, obviously, with hurricane risk. So I think that, you know, Florida is really attractive right now, but I think long term the affordability is going to be an issue especially when you factor in insurance costs.

Angela Yee

So one person was paying like six million dollars in insurance over 10 years or some was, it was that it something like that. That's insane.

Daryl Fairweather

You know, these big mansions right on the coast at sea level. And they are becoming really expensive to insure.

Angela Yee

I can’t imagine.

Jasmine Brand

There ever a scenario? I made it such a broad question. This is really like a personal question. So I have a house And I have an investment property with Angela. But then I rent a place too. And I was having this debate with a friend, like and they were saying you should never be renting. Is there ever a scenario where you think it's okay to rent?

Daryl Fairweather

What you're describing where you rent and you have an investment, that's happening more now especially because homeowners who locked in record low mortgage rates, and who want to move, now they're choosing to rent out their properties instead of selling them, right? And then when they go, they don't want to buy again at these high interest rates, so they're renting too. So there's this weird separation like the landlord and the renter and you get both sides of it. I think we're going to see it more of that, actually.

Angela Yee

Yeah, because if you're like, I locked in my interest rate on my house at 3.25 percent, I'm not selling that because interest rates are almost eight percent. But I also feel like sometimes people try to shame renting and for people are out there renting, that is not a bad thing if you're not in a position to buy, because you can actually put yourself in a terrible position if you're putting your all on the line to buy a property because everyone's telling you: “You have to buy. Why rent? Why don't you own something?”

And some of us just are not ready right now and being a homeowner is a lot of responsibility.

Daryl Fairweather

Yeah. And it ties you down. If you think you might get a new job opportunity in a new city in a couple of years, you probably shouldn't buy. It's only if you feel like you're going to stay in the property for five years or more that it becomes more financially savvy to own than to rent. But if you want to be flexible, if you don't have the down payment, there's no shame in renting.

But I would say have a savings plan. Make sure you're still putting aside money for your financial goals. It's not going to be automatic like it is with homeownership so just be really deliberate about it.

Angela Yee

Is this a good time to sell?

Daryl Fairweather

Prices are still quite high so it's actually a great time to cash out your equity. We're seeing a lot of people who live and really expensive areas, like New York or California, who are cashing out and then buying another home in all cash in a much more affordable place. Like say you have a million dollar home, most of your mortgage is paid off, you can go buy a home, all cash, and you don't have to deal with those seven percent interest rates.

Now, obviously, not everybody is so lucky to own a home with all that equity, but there are people who really made out well with how high home prices have gotten who can cash out and use that money for whatever they want.

Angela Yee

Now, another thing I've seen a lot in the news is commercial real estate because a lot of people have not returned to the office or only doing on a part-time basis. We see a lot of retail locations having to shut down. What do you see happening with that? I even saw an article about how they're trying to transform some of these commercial spaces into residential because it's just a tough time if you have commercial property.

Daryl Fairwerather

Yeah, that's a great solution for a place like New York where there isn't vacant land that can be developed to turn.

Jasmine Brand

No more land left here. Yeah,

Daryl Fairweather

So taking a commercial property and converting it to residential, it can be a great thing. I was just talking to some economists that the NYU Furman center about this and they were saying the biggest hurdle is regulation. You have to have a window in every bedroom; you have to have a bathrooms, and a lot of these commercial buildings aren't really set up like that. In these office buildings, you might have one big floor with only one bathroom in the center. So the plumbing is not really set up. So it can be quite expensive to convert a commercial property into residential.

It depends on the property and what it looks like. And you need kind of some regulatory reform, because often times, there are limits on how high residential buildings can be, which is kind of silly. And we should just clear the way for more housing.

Jasmine Brand

I wonder what they're going to do with um malls converting malls. I wonder what we're going to do it all that property.

Daryl Fairweather

It works if it's in a place that people actually want to live. Some of these malls are out in the boonies. I don't think those are going to really be ripe for conversion, but maybe there are other purposes they could use for them.

I mean I know there'sa huge refugee crisis. So I think there might be some kind of thing that they could do with that. But in order to convert it to, like market rate housing, it has to be in a place where the rents are high enough to justify the conversion.

Angela Yee

And since you brought up this refugee crisis in New York, I mean, we see all the time, we're walking past hotels that have been converted into housing. What do you think of some long-term solutions that can happen because I hear on the one hand, we have a lot of housing issues with people who are residents already. We have a lot of gentrification happening. But then we're also looking at the humanity of making sure that people who are coming here, looking for a better life, maybe fleeing whatever situation they're coming from. They also need a place to stay and so what can happen because it's really difficult in a crowded city like this too, to make sure that everybody is accommodated.

Daryl Fairweather

I think there's a lot that can be done. Again on the regulatory environment, it used to be in New York that you would have a lot of these single residency occupancy buildings. The derogatory term was flophouses. They were basically just a rented room and you have a shared bathroom, shared kitchen. But those buildings went away because they were associated with like low class people, but bringing those back would be a much, much more affordable option for people who are coming, who want to work, who just need a place to lay their head at night.

I think we need to be more creative about creating housing options that work for people who don't have much means. Unfortunately, the Airbnb thing kind of works against it because there are people who might have, you know, rented out a room to one of these refugees. And it might not be an option for them anymore.

So yeah, again, back to perspectives. You got to look at it from the perspective of these people. What's best for them? Is it better for them to live in just one room? I mean, maybe you wouldn't want to live there, but they would probably be grateful just to have a roof over their heads.

Angela Yee

There's one place that we walk past every day and you can it's migrant housing. Some people might look at it like this is terrible. But they might also be like, I’m just happy to be here. Much better situation. Community. Like the kids are outside playing.

Jasmine Brand

The kids be having a ball. Yeah. They don’t know what's going on.

Angela Yee

So since we've discussed that, you see they're allowing people to build tiny homes to have. You see this of course. What do you think about that as an option? They're paying people like credits to put a tiny home on their property and rent it out to other people.

Daryl Fairweather

Well, there are the tiny homes that are for the homelessness solution. We've seen this in Seattle. You know, it's better than a tent for example. I think what we always got to do is compare it to the alternative. Where would these people be living if they weren't living there? Maybe it's not great for, like, your personal preferences, but if the other option is living on a tent or in the street, then a tiny home can be a good option.

And then another thing is that in California, they passed all these laws. So you can build an ADU, which is like a little house. A little cottage in your backyard to rent out. That kind of legislation is great because again, it's you know, it's creating more affordable options. It's for people who maybe renting who maybe want to get some extra income or maybe you want to bring in an elderly parent to take care of. I think we got to make that easier too.

Angela Yee

And the 3D homes. That's something that. That is a thing. Now, have you seen these like 3D prints? They had the first one in Detroit. Like how? I don't even know how you do this but with the 3D printer, like the homes that they're able to create, can you explain that?

Daryl Fairweather

There's been a lot of progress in terms of the manufacturing of homes. A lot of research into it. Building is quite expensive when it comes to things like labor and materials. So yeah, the 3D homes I think is trying to create a solution to build those homes, much more efficiently and cheaply.

In a lot of places though the biggest expense for building a home is the land so you could have the structure get cheaper but if land under it costs like 500, 600 thousand dollars is not ever going to really be affordable. Even if you have, you know, 100 thousand dollar building on top of it.

Angela Yee

And as we're talking about the prices of hotels going up in New York City, in particular with them tightening all the regulations on Airbnbs. I see their talking about getting rid of all these junk fees. What do you think about that? Because sometimes you go to a hotel and say it's a hundred dollars a night and then by the time you pay, you're like house is 180 dollars a night when i didn't budget for that.

Daryl Fairweather

Yes, in economics, we have a term for that. It's called asymmetric information and it's bad.

Jasmine Brand

Asymmetric information?

Daryl Fairweather

That means that: you know something, i don't know. So the hotel knows how much you're gonna pay at the end. They really try to hide it, so you don't know

Anytime you have this asymmetric information, people, end up making decisions that they wouldn't have made otherwise. You might get a hotel, thinking it’s only going to be 150 dollars. You check out it's 300 and maybe that person couldn't afford that to begin with. So it gives more power to the hotels when they can hide those fees. So any the legislation to make that more transparent, I think it's great.

Jasmine Brand

I don't really have so much have a problem with the fees, it’s me not knowing beforehand.

Daryl Fairweather

Exactly. You want to know everything, they know you want to be on equal footing. So You can you can make just as good a decision as the person who's renting the property to you, you're renting the hotel together,

Angela Yee

You get there and then there's extra fees before you check out and then you're like, um, did you know? I never go to the desk to check out, and I should, I don't ever do that. I just leave it.

Daryl Fairweather

It makes it harder to shop around too because if one hotel has a fee that's 30 dollars. Another hotel has a fee that's 20 dollars and you don't know the difference. You might have chosen a different hotel. If you knew the actual price at checkout.

Daryl Fairweather

Well listen, i just want to thank you. You make me want to be an economist. If I would have met you when. I always say that. I love what it is that you do and howhow much knowledge that you have, which i think is really important for us to understand.

Jasmine Brand

It's so useful.

Angela Yee

Yeah, because there's so much information out there about what's going on with the economy, what's going on in the housing market. Sometimes you don't know where to look or who to listen to, but you gave us some really valuable information today. That's why every time you're in town, you have to stop by.

Daryl Fairweather

Yeah, of course, anytime.

Angela Yee

All right, well, you guys, Daryl Fairweather: make sure you check her out. Also, they can subscribe to you. You also write and she has some amazing articles. And like I said, that's what I always look at when I'm trying to figure out what's going on in the world.

Daryl Fairweather

Yeah, look me up on social media. I write for Substack I write for Forbes. I'm always out there.

Jasmine Brand

She's that girl.

Angela Yee

Subscribe, subscribe, she's that girl.

Your journey is very inspiring to those of us doing public communication from the social sciences! Thanks for sharing, love hearing about it on your Substack.

What an inspirational journey Daryl!